Getting your motorcycle on the road means making sure you have the proper insurance in place. But with so many options out there, it can be tough to know where to start looking for a policy close to home.

If you’re thinking about where to find motorcycle insurance near me, you’ve come to the right place. We’ll walk through the basics of shopping around, exploring your coverage choices and maintaining good rates.

Motorcycle Insurance Near Me: Tips to Find the Best Policy

Getting a policy near you is not difficult, and it will be even easier with these tips.

When it comes to choosing motorcycle insurance, there are a few things that you need to take into consideration.

1. Shop Around for Quotes

The first step is getting estimates from several insurers to make sure you’re not overpaying. We all want coverage without breaking the bank, right?

One way to find the best deal is looking beyond just one company. Just like with any big purchase, it pays to price shop. You never know – one company may rate you much higher than another.

For bikes, some top options that many riders turn to are Geico, Progressive and State Farm. Geico is known for simple online quotes and 24/7 claims service.

Progressive has been insuring motorcycles for decades and takes safety courses into account. State Farm has a strong reputation and local agents can provide a personalized experience.

Getting quotes from the big guys ensures you’re not missing out on their competitive rates.

The good news is you can get quotes from multiple places completely online nowadays. Simply visit insurer websites like the ones mentioned and enter some basic info about your bike, location, and background. Within minutes you’ll have apples-to-apples quotes to review.

Don’t forget to check out smaller local insurers too though – sometimes a smaller company can offer great coverage you won’t find elsewhere. The convenience of online quotes makes it a breeze to cast a wide net from the comfort of your computer.

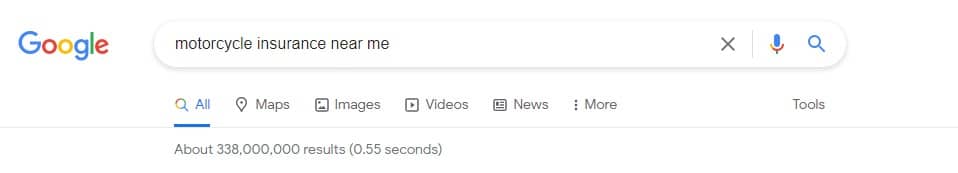

2. Search Online to Find Local Providers

When you’re looking for motorcycle insurance, it’s essential to find a provider that is local to you. This way, you can quickly go in for a consultation or ask questions.

Just enter the phrase “motorcycle insurance near me” in the Google search bar, and it will show you the agents or companies near your area. Check the following picture.

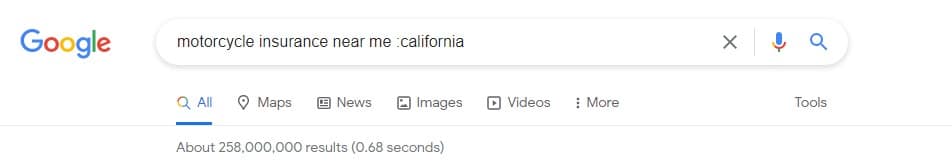

Google displays such relevant results by accessing your location data. But if you turn off the location or use a VPN for some reason, you need to input different data. If you want the names of the agencies near California, search with this phrase: motorcycle insurance near me :California (see the image below).

You can tweak the search results by asking for addresses, agents’ names, company names, and other information.

3. Factors Affecting Premium Cost

When insurers look at your application, several personal factors come into play that determine what you’ll pay.

Things like your age, years of riding experience, location, and the type of bike all affect rates. Younger and newer riders tend to pay more since accident risk is higher. Urban areas mean more traffic too.

Plus, sport bikes cost more to insure than cruisers. And if you log lots of miles for work, be ready for higher usage rates.

Here’s some good news though – insurance companies happily offer discounts for completing approved rider safety courses. Taking a basic or advanced class is totally worth it since it can shave money off your premium.

The insurers recognize the training reduces risk. One friend saved 15% by getting her motorcycle endorsement through an REI class.

Your riding habits also impact what you pay. Opting for basic liability versus full coverage like collision and comprehensive makes a difference.

Higher annual mileages result in greater premiums. And don’t forget – traffic tickets and past accident claims will raise your rates as well. Make sure to shop around and emphasize any discounts you qualify for like safety courses when talking to agents.

4. Coverage Types to Consider

To stay on the right side of the law, you’ll need at minimum the basic third-party liability insurance required by your state. This covers you in case you cause an accident and injure someone else or damage their property. Requirements vary but are usually around $15-30K per person injured. It’s your legal safety net.

But consider beefing up your protection with full coverage. Collision covers repairs if you drop your bike – we’ve all been there!

Comprehensive insurance takes care of weather or theft damage. They give peace of mind so one mishap doesn’t sink your season.

Other handy endorsements include medical payments coverage for any injuries you incur. And uninsured/underinsured motorist bodily injury protects you from financial loss if another rider has no insurance.

It’s a bummer thinking about it, but you never know when some cager might pull out in front of you without coverage. Better to have these extra sets of eyes watching your backside.

5. Finding an Local Insurance Agent

While online quotes give you plenty of options, there’s also perks to connecting with an agent close to home. A good local guy knows the ins and outs of insuring bikes in your neck of the woods.

These pros work with major carriers and can shop their rates for you, saving legwork. My agent even got me a special deal through his partnership with Progressive.

Meet up in-person and get personal advice tailored to your situation. Ask all your coverage questions and make sure you really understand what you’re buying before signing on the dotted line.

An agent acts as your advocate if you ever need to file a claim too. Better to build that relationship with someone invested in your community.

Don’t be afraid to interview a few agencies until you find an agent who gives you confidence. In the end, that human touch of a local advisor could be the difference between high quality protection and headaches down the road.

You can also contact your state’s Department of Insurance. Each state has its regulations for motorcycle insurance, and the Department of Insurance can help you find the right policy for your needs.

6. Maintain Good Rates

Once insured, stay on top of payments and obey traffic laws. Insurers reward safe driving with lower renewals. A speeding ticket now could end up costing way more due to increased premiums long-term.

Also avoid switching policies each year. Insurers see that as a red flag that you’re a risky customer. It’s better to renew with your current company to keep rates steady if they’re treating you right.

Be sure to check in annually though. Circumstances change, so policies need updates. Recently married? Built a garage? A review ensures you have the right protection for your situation. Don’t get over-insured and waste money, but don’t risk being under-covered either.

Riding smart and maintaining a good relationship with your insurer is just part of being a savvy motorcyclist. Keep rates low and coverage high with simple diligence every year.

FAQs about Motorcycle Insurance Near Me

How can I get a motorcycle insurance quote near me?

Check online insurer websites, call several local insurance agencies, or ask motorcycle dealers for referrals. Get quotes with the same info to compare easily.

Which insurance companies provide motorcycle insurance near me?

Many national insurers offer motorcycle policies locally including Progressive, State Farm, GEICO and Allstate. Check with local independent agents too.

What documents do I need to get motorcycle insurance locally?

You’ll need your motorcycle’s VIN, make, model and year. You’ll also provide your license info, driving history, coverage needs and payment method.

Can I insure my bike at any nearby agency?

Yes! Since insurance is regulated by state laws, most agents can write policies for customers within their state regardless of location.

How can I find highly rated motorcycle insurance locally?

Ask friends, coworkers or motorcycle groups for recommendations. Check online reviews for local agencies. Compare multiple options for the best rates, coverage and service.

Do motorcycle insurance companies come to my home?

Rarely. Most policies are purchased online, by phone or by visiting an insurance office. However, some companies do offer in-home consultations for complex cases.

What should I ask my local motorcycle insurance agent?

Make sure they offer the coverage you need, clarify any policy exclusions, discuss safety options to reduce rates and confirm claims handling processes in the event of an accident.

Can an insurer drop my motorcycle insurance without notice?

No, insurers cannot drop or non-renew your policy without notifying you in writing in advance. However, they can cancel immediately for non-payment of premiums or if you provided false information on your application.

Will my insurance cover me anywhere, or just locally?

Comprehensive insurance covers your motorcycle wherever it goes, not just locally. However, liability coverage only applies in the state(s) specified in your policy.

Why do motorcycle insurance rates differ so much locally?

Rates vary widely by insurer based on their risk assessment models, coverage options, and claims experience in different regions. Your personal profile also impacts the rate you’re offered.

Can I transfer an existing motorcycle policy locally?

Yes! If you already have a policy but need to work with an agent closer to your new residence, most insurers allow you to transfer your coverage to an agency nearer to you. Just contact your insurer.